Banking from home

Managing your account

Dealing with difficult times

What are the different balances displayed in Online banking?

Recently we’ve changed the way we display your accounts and balances in Online banking to give you a clearer view of your money.

Where can I find my IBAN and BIC details?

You can find your International Bank Account Number (IBAN) and Bank Identifier Code (BIC) on your bank account statements, using online banking or with our mobile app.

I am going abroad and don't want my card to be blocked, what should I do?

If you're planning to use your debit card abroad then it is best that you let us know to reduce the likelihood of your transactions being blocked.

What is a card-reader and how do I use one?

A card-reader gives you an extra level of security when using Online banking. You'll use a card-reader to set up a payee, make a payment for the first time online or update your details.

How do I get the mobile banking app?

Once you are registered for Online banking you will be able to download and register for the mobile banking app. The app is available on compatible iOS and Android devices.

What are the different payment limits?

There are different payment limits depending on which type of customer you are and the type of payment you are making.

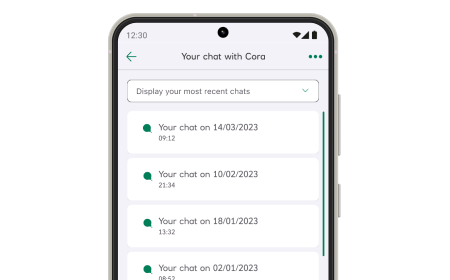

Cora is here to help you

Cora, our digital assistant, is available 24/7 to help answer your questions about everyday banking. Cora can also show you how to do things like make a payment or manage your direct debits.

If you log into online banking or the mobile app before starting a chat, Cora can offer additional support including:

- updating your address

- ordering a PIN reminder

- reporting your card lost or stolen

To chat with Cora, choose 'Chat to Cora' at the bottom right-hand side of most webpages.